Community

Message Forum

Photo Gallery

Event Calendar

Book Reviews

Bronco Wallpaper

Bronco FAQ

Link Back to CB!

Photo Gallery

Event Calendar

Book Reviews

Bronco Wallpaper

Bronco FAQ

Link Back to CB!

Buy / Sell

Bronco Tech

3 Arm Wiper Setup

Fix Motor Mount

Roll Cage Braces

Throttle Body 65mm

Wheel Alignment

Heat Riser Replacement

Vent Window Repair

Center Console Mount

Straighten Bumper

Ford 6R80 6 spd

More Tech...

Fix Motor Mount

Roll Cage Braces

Throttle Body 65mm

Wheel Alignment

Heat Riser Replacement

Vent Window Repair

Center Console Mount

Straighten Bumper

Ford 6R80 6 spd

More Tech...

Install the app

-

Welcome to ClassicBroncos! - You are currently viewing the forums as a GUEST. To take advantage of all the site features, please take a moment to register. It's fast, simple and absolutely free. So please join our community today!If you have problems registering or can't log into your account, please contact Admin.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Hagerty Insurance a joke

- Thread starter RB70bronco

- Start date

Amac70

ME

- Joined

- Mar 27, 2002

- Messages

- 3,269

, don't try and wheel it...won't cover a thing if it happens out in the woods.

and that is how it should be, if you play with your toys and break them while playing it is your fault no one else should have to pay for that.

Hmm - guess I'll have to check my Hagerty policy. I thought it covered theft and burning down in my garage.

My other Bronco is insured by Allstate - one car garage- Haggerty will only insure it if it's parked in a garage. Interestingly a friend with a classic Chevy didn't have to prove his was garages and wasn't even asked. But he does live in Washington State; I don't know if that makes a difference.

The Allstate premium is 43$ a month and I thought had the same coverage as my Hagerty policy at less than $20 a month.

Shx

My other Bronco is insured by Allstate - one car garage- Haggerty will only insure it if it's parked in a garage. Interestingly a friend with a classic Chevy didn't have to prove his was garages and wasn't even asked. But he does live in Washington State; I don't know if that makes a difference.

The Allstate premium is 43$ a month and I thought had the same coverage as my Hagerty policy at less than $20 a month.

Shx

msweb

Bronco Guru

- Joined

- Aug 29, 2003

- Messages

- 2,377

and that is how it should be, if you play with your toys and break them while playing it is your fault no one else should have to pay for that.

So if you're out driving on snow covered roads because you want to go out to a movie with your lady, lose control and wreck, your insurance company should'nt have to pay? After all, wouldn't that be taking one of your toys out to play (and I'm refering to the Bronco, not trying to imply anything else)?

Of those of you that have other than basic liability, have you ever filed a claim and if so, what type of hassles did you run into? I've only had liability but when I get mine back on the road I'll want a stated value policy. What stipulations should I be on the lookout for other than offroad use and mileage?

Amac70

ME

- Joined

- Mar 27, 2002

- Messages

- 3,269

how is going out wheeling and going to a movie the same thing. and yeah if i was out screwing around in the snow and hit something I would not be claiming it if i was as fault for screwing around in the first place. old concept you pay to play. just like when im in the rocks or out on the trail. I went on a trail ride about 3 years ago to a place called evens creek. perfectly strait bronco fairly fresh paint job on most of it. came away with 5 dents. didn't need to cry to anybody or make my insurance fix it. i wanted to be there i knew the risks. and i have had claims on my bronco before but i was not at fault for one and didn't claim any damage on the other. one they totalled it cut me a nice check and gave it back to me for i believe 300.00. same bronco i have today. the other accident was my fault took out the side of a van, only damage i had was paint transfer on my quarter gaurds. no claim on that.

Attachments

- Joined

- Nov 1, 2007

- Messages

- 694

Have mine insured through all-state as well. Great policy and awesome price. no restrictions to speak of.

unless of course it's my 17yr old step son. he thinks no-one under 35 can drive it ;D

Nice!

NC-Fordguy

Bronco Guru

So if you're out driving on snow covered roads because you want to go out to a movie with your lady, lose control and wreck, your insurance company should'nt have to pay? After all, wouldn't that be taking one of your toys out to play (and I'm refering to the Bronco, not trying to imply anything else)?

Of those of you that have other than basic liability, have you ever filed a claim and if so, what type of hassles did you run into? I've only had liability but when I get mine back on the road I'll want a stated value policy. What stipulations should I be on the lookout for other than offroad use and mileage?

Talking with haggerty and reading my policy this is what I have come up with

Vehicle must be garage kept. It does not say anything about in the event of fire in that garage claim will be denied. In fact my sisters husband has a boss 429 mustang and because of the value of the vehicle they insisted on a smoke/sprinkler system. Kind off odd that they will insist on that if it's pre-determined they will deny a claim.

There is no mileage limit.

Vehicle is not to be used for commuting

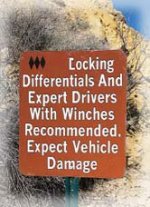

Vehicle is not to be used for off-roading/camping.

Basically the vehicle is meant to be driven for pleasure reasons or to club/show events or to garages for repairs.

IMO going to a movie would be a pleasure event.

I wheel one of my broncos. If I damage it off road I figure that is my own stupidity and wouldn't file a claim even if I was covered

My main reason for purchasing haggerty was for protection from morons on the road and the uninsured. I was once in an accident in which the other driver was at fault. He was an illegal mexican with a car that didn't belong to him, with no insurance and had an expired mexican liscense(providing that liscense was actually his) He got tickets out of the yazoo and never showed up to court--not surprised about that

My F-series truck was totaled and split my knee cap and tore ligaments. Cost me out of pocket thousands and thousands of dollars. If something like this was ever to happen to me again in my bronco at least my investment is protected

msweb

Bronco Guru

- Joined

- Aug 29, 2003

- Messages

- 2,377

how is going out wheeling and going to a movie the same thing.

You get in the vehicle and drive it to where you want to go for the entertainment. The main difference is the type of road - Pavement, Concrete, Gravel, Dirt, Cobblestones. Then there's road conditions such as snow, mud, hard and flat, rocks.

You're here and you want to go there. I believe I'd like my route to be my choice. I can travel the gravel road in rainy conditions, The dirt road when it has 4" of snow or maybe the cobblestone road during an ice storm.

Fact is, It's just a route I'm taking to get to the entertainment. I'm not purpously looking to break someting or wreck, noy many are. Do insurance companies charge more on monday because the guy has to use the interstate to get to work and less on Thursdays because he drives on one lane country roads? No. We pay them based on risk - period. The type of road we're on may effect the risk and therfore the rate, but automatically banning/not covering a vehicle that's going offroad only becuse they're going offroad is BS. You insure a boat to go in the water but if it's wrecked on a road, they still pay. If your airplane landa in your fishing pond, they'll pay...

- Joined

- Nov 1, 2007

- Messages

- 694

how is going out wheeling and going to a movie the same thing. and yeah if i was out screwing around in the snow and hit something I would not be claiming it if i was as fault for screwing around in the first place. old concept you pay to play. just like when im in the rocks or out on the trail. I went on a trail ride about 3 years ago to a place called evens creek. perfectly strait bronco fairly fresh paint job on most of it. came away with 5 dents. didn't need to cry to anybody or make my insurance fix it. i wanted to be there i knew the risks. and i have had claims on my bronco before but i was not at fault for one and didn't claim any damage on the other. one they totalled it cut me a nice check and gave it back to me for i believe 300.00. same bronco i have today. the other accident was my fault took out the side of a van, only damage i had was paint transfer on my quarter gaurds. no claim on that.

Mike, he has a point. If you go drive your car into a ditch on purpose and file a claim on it, it would be fraud. If you are out wheeling and rip a fender off, it would be kinda the same thing. If you didn't want it wrecked, you shouldn't have been there.

Driving on a marked road in the snow would be just normal use and insurable as long as your policy doesn't preclude it like I am sure most specialty/antique auto insurance would.

- Joined

- Nov 1, 2007

- Messages

- 694

But with Haggerty you can't let the bronco out of your sight.

Ask the agent if the Bronco gets stolen while you're at work --> Not covered. And it has to be garaged. If it gets stolen or burned down in the garage, guess what, thats homeowners insurance.

So what actually does Haggerty insure??

Funny, most homeowners policies would say that that is what auto insurance is for, unless you have a rider for your homeowners to cover it.

NC-Fordguy

Bronco Guru

You get in the vehicle and drive it to where you want to go for the entertainment. The main difference is the type of road - Pavement, Concrete, Gravel, Dirt, Cobblestones. Then there's road conditions such as snow, mud, hard and flat, rocks.

You're here and you want to go there. I believe I'd like my route to be my choice. I can travel the gravel road in rainy conditions, The dirt road when it has 4" of snow or maybe the cobblestone road during an ice storm.

Fact is, It's just a route I'm taking to get to the entertainment. I'm not purpously looking to break someting or wreck, noy many are. Do insurance companies charge more on monday because the guy has to use the interstate to get to work and less on Thursdays because he drives on one lane country roads? No. We pay them based on risk - period. The type of road we're on may effect the risk and therfore the rate, but automatically banning/not covering a vehicle that's going offroad only becuse they're going offroad is BS. You insure a boat to go in the water but if it's wrecked on a road, they still pay. If your airplane landa in your fishing pond, they'll pay...

Off roading and driving on a gravel or dirt road are two different things. There are roads that exist that are not paved.

A gravel or dirt road is still a road, it's merely an unpaved road. My policey does not state that an unpaved road is off roading

I think some common sense is in order here..............

msweb

Bronco Guru

- Joined

- Aug 29, 2003

- Messages

- 2,377

If you didn't want it wrecked, you shouldn't have been there.

I disagree Carl. Just because I'm driving on a dirt or gravel road that is not heavily taveled by others due to the fact that it's terrain can be quiet technical, it does NOT mean that I intend to incur some type of body damage. In all of the wheeling I've done in my Bronco, the only "body damage" I've accomplished was dinging up the chrome strip of trip that runs down the side of the body. I'm not trying to wreck my truck just because I'm off of a maintained road. I'm just driving and having fun.

In what you said above, if a Soccer mom is driving her teenage daughter to the mall in the middle of a snow storm and has an accident, would you say that she isn't covered because if she didn't want it wrecked she sholdn't have been there for recreational purposes?

If I drive through the state of PA after dark and I hit a deer, does your line apply?

How about this... You drive your Bronco out to BYOB to meet everyone in the group. They suggest a group picture so you drive out in the middle of a field to park your vehicke with the group. In transit, you hit a sink hole that you didn't see and front end drops in, damaging the bumper, fenders, grill and radiator. Can they deny your claim because you were attending an offroad event?

Fact is, I should be able to go into an insurance company and say "I use my vehicle for this purpose". The asses the value of the vehicle, the risk of the activity and apply a rate that they deem as appropriate.

That, Mr. NC-Fordguy, would be common sense.

NC-Fordguy

Bronco Guru

I disagree Carl. Just because I'm driving on a dirt or gravel road that is not heavily taveled by others due to the fact that it's terrain can be quiet technical, it does NOT mean that I intend to incur some type of body damage. In all of the wheeling I've done in my Bronco, the only "body damage" I've accomplished was dinging up the chrome strip of trip that runs down the side of the body. I'm not trying to wreck my truck just because I'm off of a maintained road. I'm just driving and having fun.

In what you said above, if a Soccer mom is driving her teenage daughter to the mall in the middle of a snow storm and has an accident, would you say that she isn't covered because if she didn't want it wrecked she sholdn't have been there for recreational purposes?

If I drive through the state of PA after dark and I hit a deer, does your line apply?

How about this... You drive your Bronco out to BYOB to meet everyone in the group. They suggest a group picture so you drive out in the middle of a field to park your vehicke with the group. In transit, you hit a sink hole that you didn't see and front end drops in, damaging the bumper, fenders, grill and radiator. Can they deny your claim because you were attending an offroad event?

Fact is, I should be able to go into an insurance company and say "I use my vehicle for this purpose". The asses the value of the vehicle, the risk of the activity and apply a rate that they deem as appropriate.

That, Mr. NC-Fordguy, would be common sense.

Common sense says if you drive it into a field you're not on a road.

Fact is if haggerty or any other insurance for that matter does not cover a vehicle to your liking don't buy insurance from them. Seems quite simple enough.

msweb

Bronco Guru

- Joined

- Aug 29, 2003

- Messages

- 2,377

The common sense I was referring to is that you should be able to approach an insurance company and have them write a policy that suits your needs/applications and requirements for a fair premium rather than have something automatically excluded.

Thats the last I have to say on the matter unless others would like to share some claims they've filed on their Broncos and discuss any resistance they've encountered along the way.

Thank you all in advance for your positive input.

Thats the last I have to say on the matter unless others would like to share some claims they've filed on their Broncos and discuss any resistance they've encountered along the way.

Thank you all in advance for your positive input.

- Joined

- Nov 1, 2007

- Messages

- 694

I have to agree with NC on this Mike. Your using the soccer mom in a snow storm is an apples and oranges comparison. An off-road trail is a road by only the broadest stretch of the term.

It is all about risk. If someone gets drunk and has a wreck, do you think their insurance should/will pay for damages to the vehicle?

Other than that I would say consult with your insurance agent. If he will cover it I would think the premium and deductable would keep you from filing a claim for it.

I guess your internet is cooperating tonight

It is all about risk. If someone gets drunk and has a wreck, do you think their insurance should/will pay for damages to the vehicle?

Other than that I would say consult with your insurance agent. If he will cover it I would think the premium and deductable would keep you from filing a claim for it.

I guess your internet is cooperating tonight

RB70bronco

Full Member

They must have made some changes since you guys got it. They told Me I could only drive 2000 a year, the garage had to have dead bolts and pad locks on the over head doors. The best part was they told me that I could not be insured since the are to drivers in the house our primary vehicles have to be 5 years old or newer, so my 2004 F150 excluded me. But its not a big deal this insurance is not a good fit for me since I like to drive my Bronco and sometimes it gets left out at night and I like to wheel it once in a while.

- Joined

- Jun 11, 2004

- Messages

- 11,883

They must have made some changes since you guys got it. They told Me I could only drive 2000 a year, the garage had to have dead bolts and pad locks on the over head doors. .

Regarding the above and the previously discussed restrictions; again, that is why I like Allstate. Zero such restrictions listed in the policy..in fact, I compared my Allstate 'classic vehicles' policy language to my regular policy with Allstate and could find no differences whatsoever. Its simply a different ' class' of vehicle.

- Joined

- Nov 1, 2003

- Messages

- 770

A big problem with getting insurance for a classic vehicle is the inconsistent info we get from the companies. It's evident in the first couple posts of this thread: you need photos/you don't; you need appraisal/you don't; drive it to work is OK/no it isn't. And I'm talking about different answers from the same company.

A bigger problem is going to be if you happen to get the agent who says "no problem" to these things and later when something bad happens you find out "it's not covered." My advice is get it in writing, even if it's an email or some other correspondence. The policy should say all these things, I know, but a clear written approval is worth something.

Another suggestion: check on your policy regularly, even once or twice a year, to be sure nothing has changed and what you understand is what you are getting. I had Safeco a few years ago and understood it was full-coverage, no restrictions, and agreed value. At some point when I went to add another vehicle the customer service rep informed me the Bronco was under "classic" status (meaning limited miles) and insured for Blue Book. We all know what that is.

Dan

A bigger problem is going to be if you happen to get the agent who says "no problem" to these things and later when something bad happens you find out "it's not covered." My advice is get it in writing, even if it's an email or some other correspondence. The policy should say all these things, I know, but a clear written approval is worth something.

Another suggestion: check on your policy regularly, even once or twice a year, to be sure nothing has changed and what you understand is what you are getting. I had Safeco a few years ago and understood it was full-coverage, no restrictions, and agreed value. At some point when I went to add another vehicle the customer service rep informed me the Bronco was under "classic" status (meaning limited miles) and insured for Blue Book. We all know what that is.

Dan

Heus33

Bronco Guru

- Joined

- Jun 1, 2005

- Messages

- 7,408

The most important question you can ask is "If I'm at the grocery store and my Bronco is stolen from the parking lot, is it covered?" And get their answer in writing.

Most the specialty insurance companies will not cover a vehicle thats out of your sight - thats why places like Haggerty state that the car can only be driven to/from shows and on the occiasional pleasure cruise. Going to the grocery store is commuting and odds are your claim will be denied.

Remember - everyone's insurance company is the best ever...until they need to make a claim...

I'm with Geico and they have told me that the modifications on my Bronco will not be taken into account if the vehicle is stolen. It will be based on fair market value using Edmunds, KBB and like sales. I feel confident that I'd be able to get about $15,000 for mine but thats not near what it would cost to replace (and yes, they will insure it if its stolen at work/grocery store/movies, etc). In my research Allstate appears to be one of the best choices - they have a stated value policy that covers classics with few restrictions. Just gotta wait another year for my wife's speeding ticket to fall off before switching... %)

Most the specialty insurance companies will not cover a vehicle thats out of your sight - thats why places like Haggerty state that the car can only be driven to/from shows and on the occiasional pleasure cruise. Going to the grocery store is commuting and odds are your claim will be denied.

Remember - everyone's insurance company is the best ever...until they need to make a claim...

I'm with Geico and they have told me that the modifications on my Bronco will not be taken into account if the vehicle is stolen. It will be based on fair market value using Edmunds, KBB and like sales. I feel confident that I'd be able to get about $15,000 for mine but thats not near what it would cost to replace (and yes, they will insure it if its stolen at work/grocery store/movies, etc). In my research Allstate appears to be one of the best choices - they have a stated value policy that covers classics with few restrictions. Just gotta wait another year for my wife's speeding ticket to fall off before switching... %)

kayakersteve

Sr. Member

Remember - everyone's insurance company is the best ever...until they need to make a claim...

AMEN!! Thats the truth